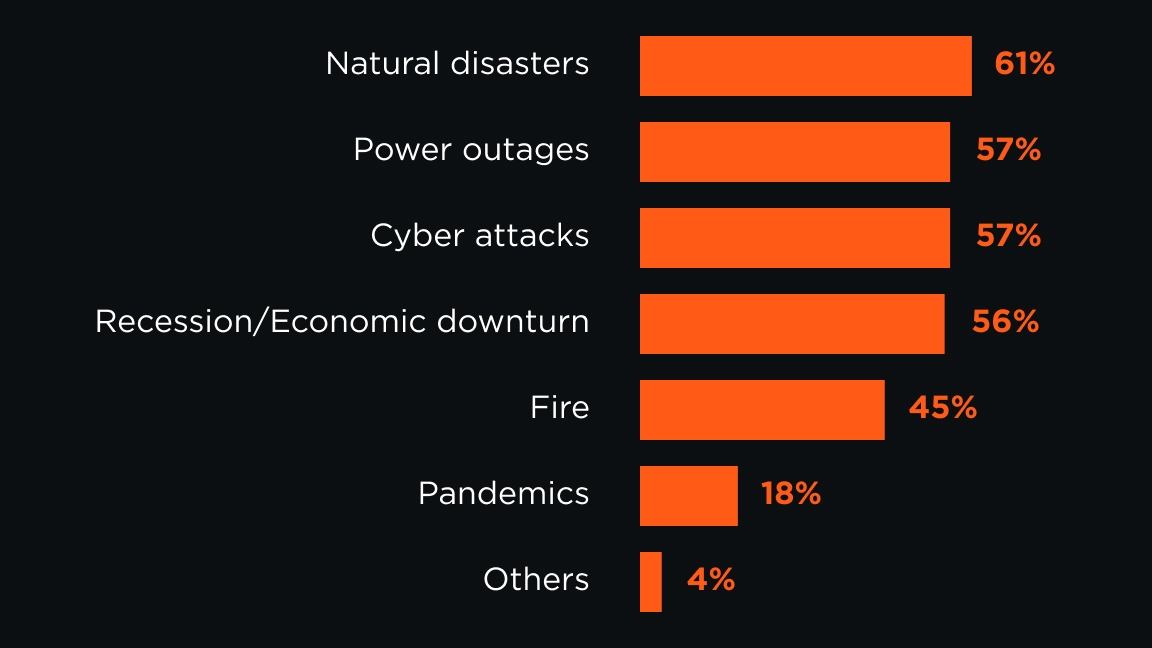

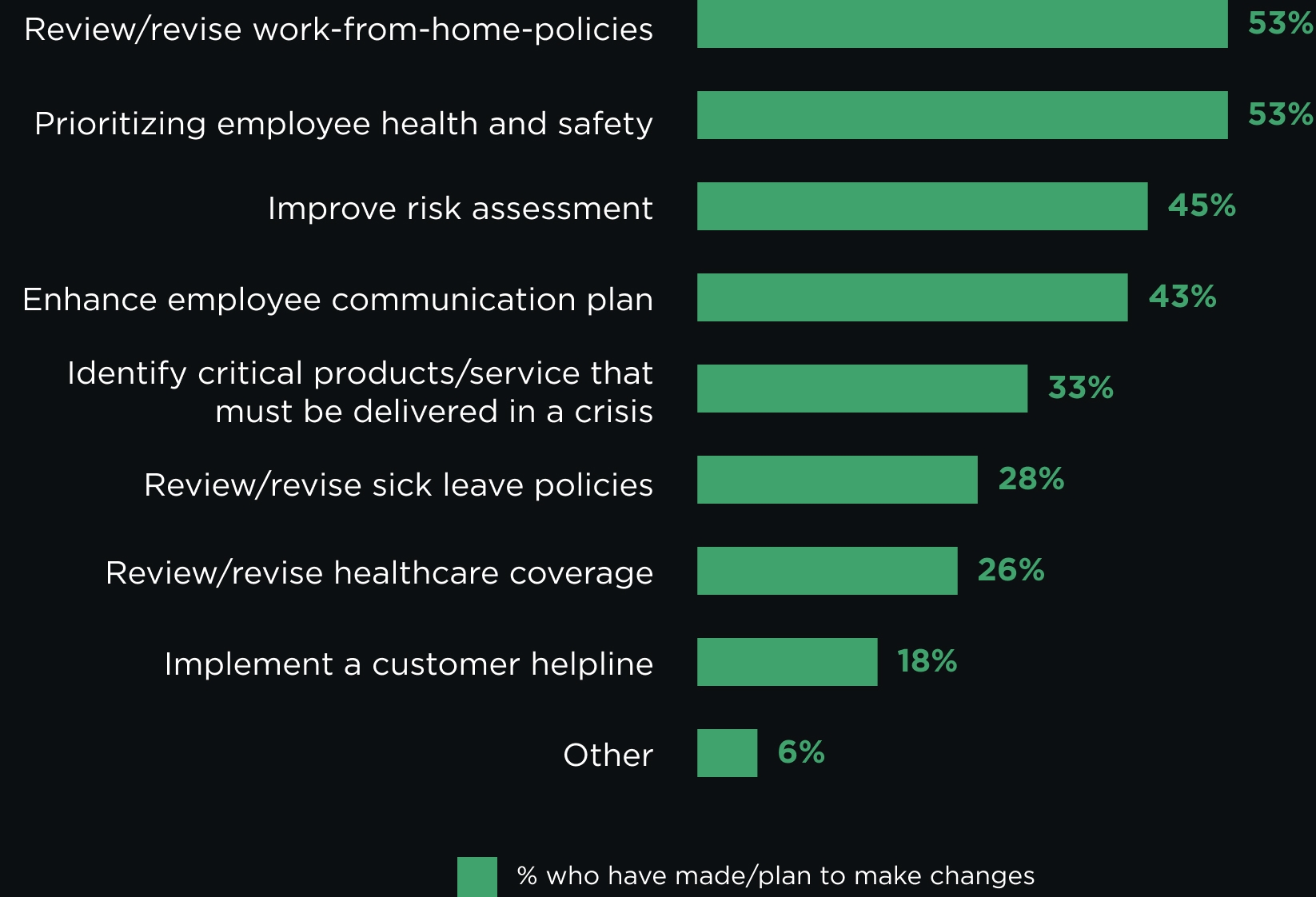

8. Business Continuity Planning

While the majority of SMBs did have a formalized business continuity plan in place before the COVID-19 crisis hit, most of these plans did not specifically account for pandemics. Still, the majority of SMB leaders said their plan was effective in helping them handle the current situation.

"7 in 10 SMBs have a formalized business continuity plan in place"