Payroll Services

Access a simple, yet powerful payroll processing solution for managing payroll and navigating evolving tax codes.

Streamline payroll administration

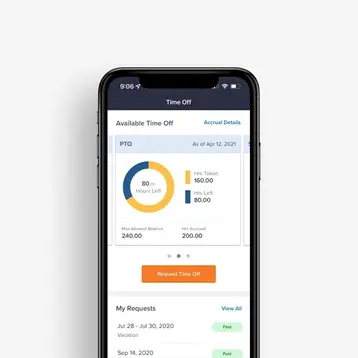

Our online payroll software includes payroll processing with direct deposit and debiting, plus we make it easy to go paperless with e-pay stubs, pay cards and electronic W-2 preparation and delivery. Our platform also lets your employees view pay stubs and request time off conveniently from our mobile app.

Additionally, you can integrate with your favorite accounting systems, like Quickbooks® Online, allowing a convenient sync to your general ledger.

Simplify taxes while mitigating risk

We calculate and withhold federal, state and local payroll taxes paid through our platform—and electronically submit withholdings. We can also handle your payroll administration tax documents, including electronic W-2 preparation and delivery, and employees can choose to import their W-2s directly into TurboTax®. We’ll even manage unemployment taxes and claims for you.

Integrated payroll applications

of surveyed organizations said TriNet's Payroll Processing delivers time savings.*

of surveyed organizations said TriNet's Payroll Processing helps maintain payroll and tax compliance.*

of surveyed organizations said TriNet's Payroll Processing helps reduce payroll errors.*

Onboard and pay your independent contractors

You rely on independent contractors to build an optimal workforce that's agile and cost-effective. With TriNet Contractor Payments businesses can conveniently and easily pay independent contractors.

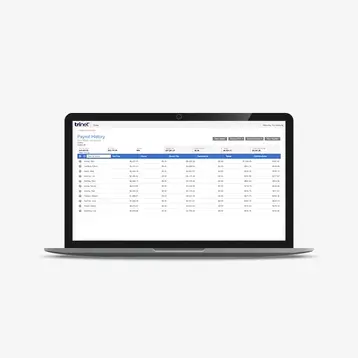

Expansive reporting capabilities

Turn your payroll data into actionable insights to help you make informed business decisions. Easily generate visualizations and detailed reports using your people data with just a few clicks. And for added convenience use our accounting system integrations (e.g., QuickBooks Online) to connect your payroll data to your general ledger.

Total compensation statement

Reinforce your company’s investment in your employees through a total compensation statement. Each report is a personalized statement that shows the total value of an employee’s pay package.

- Provide employees greater insights into their total compensation package, categorized by salary, health benefits, income protection, and retirement benefits

- Gain visibility into an individual’s contribution as well as your company’s contribution to each of these categories

- View salary and benefits as a percentage of an employee’s total compensation

FAQs

Fact Sheet 17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) outlines the federal criteria for each of the white-collar exemptions under which an employee may be designated under the FLSA. Different exemptions and criteria may apply at the industry, local, or state levels.

TriNet provides its customers with a tool to assist them in conducting individualized risk assessments prior to making final FLSA status determinations for their employees.