Welcome to HR Plus

HR Plus is TriNet’s Administrative Services Organization (ASO) that simplifies HR, payroll, and compliance for small and medium-sized businesses. With our personalized support team and all-in-one technology platform, we help you save time and money while navigating compliance and providing a smooth experience for you and your employees.

Explore HR Plus Packages

TriNet’s HR Plus packages offer scalable support for growing companies, from foundational HR services to advanced strategic guidance. Whether you're looking for help with compliance, payroll admin, or employee engagement, our packages are designed to meet you where you are—and help you get where you want to go.

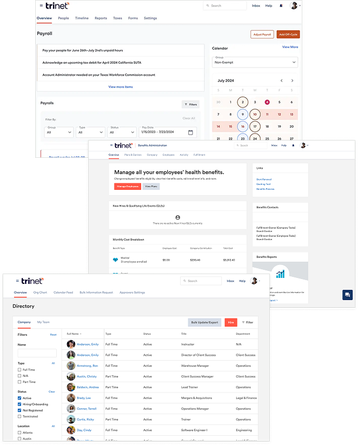

All-in-one Software

Our HR platform is included with HR Plus and is accessible to you and your outsourced service team to help automate processes across recruiting, HR, payroll and benefits so you can focus on what matters most — your people.

Service Levels That Scale With Your Business

HR Manager - Comprehensive support for HR and payroll tasks, from a dedicated team of experts.

Payroll Manager - A dedicated payroll manager to handle your payroll runs and tax compliance.

Payroll Tax Compliance Manager - Expert assistance with payroll tax account setups and ongoing payroll tax monitoring.

HR Advisory - Experts to advise you on HR and payroll.

HR Manager

Comprehensive support for HR and payroll tasks, from a dedicated team of experts.

For companies that really want to outsource most—if not all—of their HR operations and want to remain the employer of record. The responsibilities of your HR Manager include everything in Payroll Tax Compliance Manager and everything in Payroll Manager plus employee onboarding and offboarding, representing your organization in unemployment claims, calculating taxes, reviewing your policies and procedures, and more.

Payroll Manager

A dedicated payroll manager to handle your payroll runs and tax compliance.

Your manager will help you stay on top of compliance through expert knowledge of state and federal employer regulations, jurisdiction monitoring, and having the responsibility to process accurate payroll and deductions.

Payroll Tax Compliance Manager

Expert assistance with payroll tax account setups and ongoing payroll tax monitoring.

Our team of professional tax experts can save your company from penalties and fees by actively monitoring for new and existing accounts, monitoring workforce address and compensation changes and monitoring regulatory changes to payroll jurisdictions that impact your business.

HR Advisory

Experts to advise you on HR and payroll.

Access our team of HR and payroll experts, to answer your HR questions and provide best practices. Our team is ready to connect and provide the guidance you're looking for and get you through those tough questions.

Protecting Your Business Through Reviews

Tangible benefits, real satisfaction

of SMBs agree that HR Plus platform has helped their organization access data and reporting to help inform decisions.

of surveyed customers agree that HR Plus platform has helped their organization improve onboarding experience.

of SMBs using Payroll agreed that HR Plus platform helps their company save time and money.

Source: TechValidate survey of 31 TriNet HR Plus platform users, April 2024

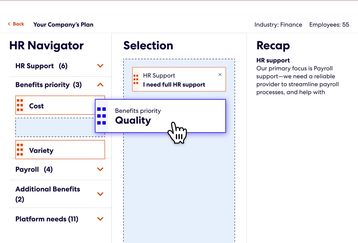

Know Your Needs. Understand Your Costs.

.jpg?format=webp&quality=75&disable=upscale&width=358)

.jpg?format=webp&quality=75&disable=upscale&width=358)

FAQs

Learn how TriNet’s comprehensive HR Plus solutions can help your business.

Fill out the form and a member of our team will reach out to schedule time for a conversation.