Payroll Processing

Access intuitive payroll software combined with expert support to simplify payroll processing and navigate payroll tax compliance with confidence.

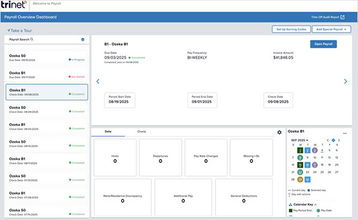

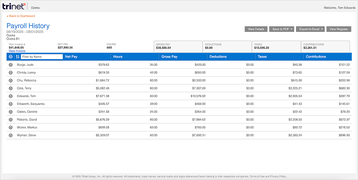

Streamline Payroll Administration

TriNet’s integrated payroll solution connects key areas of your business, including time and attendance, expense management and benefits administration, keeping payroll up to date with timely submitted changes for faster payroll processing. Enjoy the added convenience of syncing payroll with your general ledger through integrations with popular accounting systems like Quickbooks® Online.

No Matter Your Size, We Got You.

TriNet solutions work for both fast-growing start-ups and more mature companies with a wide range of in-house HR support. We offer comprehensive HR services with a dedicated team that works beside the one you already have.

of surveyed organizations said TriNet's Payroll Processing delivers time savings.*

of surveyed organizations said TriNet's Payroll Processing helps maintain payroll and tax compliance.*

of surveyed organizations said TriNet's Payroll Processing helps reduce payroll errors.*

Dedicated Expertise for Payroll Success

Dependable Payroll Tax Compliance Support

TriNet combines automation with access to dedicated payroll tax specialists to simplify complex payroll tax administration. From automated payroll tax calculations and timely tax filings for payroll processed on our platform, to mobile access for employee tax forms, count on TriNet to help you mitigate risk and navigate payroll tax compliance with confidence.

Modern Mobile Design

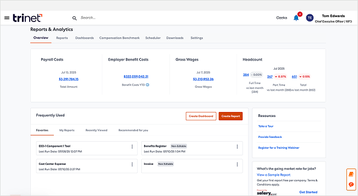

Actionable Data Insight

Onboard and Pay Independent Contractors

Independent contractors are often engaged to help your business. With TriNet Contractor Payments, your company can conveniently and easily pay independent contractors.

Services | PEO |

|---|---|

Payroll processing & administration | |

Payroll tax filing and compliance support** | |

Benefit deductions | |

Workers’ compensation & risk mitigation | |

Dedicated HR support team | |

Employee self-service portal | |

*** | |

Accounting integrations | |

Mobile pay stubs |

**For payroll processed through TriNet’s platform.

*** Additional terms and cost may apply.

People Also Ask

HR Plus and its clients are not in a co-employment relationship, and therefore it is not a co-employer. Self-service options are also available with HR Plus, offering you core payroll and HR tools while you can manage more functions in-house.