Welcome to

HR Plus

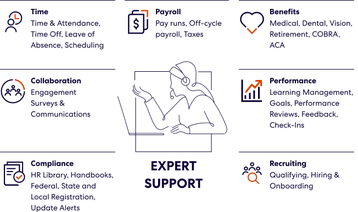

Outsourced HR services plus HR technology to help your business thrive.

![[Missing alt text]](https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt876bd459b38fd125/65779a1741160e61b13572bd/solutions-HR-Plus.jpg?format=webp&quality=75&disable=upscale&width=358)

A Comprehensive Solution for Managing the Employee Lifecycle

HR Plus simplifies HR, payroll, and compliance for small and medium-sized businesses. With our personalized support team and all-in-one technology platform, we help you save time and money while navigating compliance and providing a smooth experience for you and your employees.

All-in-one Software

Our HR platform is included with HR Plus and is accessible to you and your outsourced service team to help automate processes across recruiting, HR, payroll and benefits so you can focus on what matters most — your people.

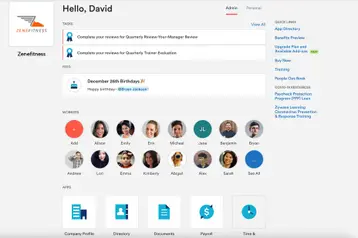

A platform for everybody

All-in-one HR platform that helps you manage workforce data, onboarding, time tracking, performance management and more.

Payroll processing built right in

Three-click payroll automatically syncs data across your platform, resulting in fewer data-entry errors, quicker payroll processing and a happier you.

Modern benefits administration made easy

With a single dashboard that you, your employees and your brokers share, your open enrollment and benefits admin is easy. Employees enroll in plans right in the mobile app.

Compliance and risk

Leverage a trusted solution to ensure you’re always within compliance across HR, payroll and benefits regulations. Make administration easy and mitigate risk for your business.

Service Levels That Scale With Your Business

HR Manager

Comprehensive support for HR and payroll tasks, from a dedicated team of experts.

For companies that really want to outsource most—if not all—of their HR operations and want to remain the employer of record. The responsibilities of your HR Manager include everything in Payroll Tax Compliance Manager and everything in Payroll Manager plus employee onboarding and offboarding, representing your organization in unemployment claims, calculating taxes, reviewing your policies and procedures, and more.

Payroll Manager

A dedicated payroll manager to handle your payroll runs and tax compliance.

Your manager will help you stay on top of compliance through expert knowledge of state and federal employer regulations, jurisdiction monitoring, and having the responsibility to process accurate payroll and deductions.

Payroll Tax Compliance Manager

Expert assistance with payroll tax account setups and ongoing payroll tax monitoring.

Our team of professional tax experts can save your company from penalties and fees by actively monitoring for new and existing accounts, monitoring workforce address and compensation changes and monitoring regulatory changes to payroll jurisdictions that impact your business.

HR Advisory

Experts to advise you on HR and payroll.

Access our team of HR and payroll experts, to answer your HR questions and provide best practices. Our team is ready to connect and provide the guidance you're looking for and get you through those tough questions.

Tangible benefits, real satisfaction

less time onboarding new hires

save up to one week per year in HR administration

less time spent on payroll and benefits

Protecting Your Business Through Reviews

HR Plus reviews help uncover underlying HR and payroll tax issues that sometimes can go unnoticed yet are associated with big consequences. These issues could leave your business open to liability and further penalties or fines. Our team will perform reviews and provide solutions to guide you towards compliance.

Payroll Tax Compliance Review

Payroll Tax Compliance Review provides a consultation with one of our payroll tax specialists to review your payroll tax documents and processes. We assess your current situation, help identify concerns and provide best practice guidance to navigate any concerns.

Payroll Tax Compliance Review services include but not limited to:

- Review of active workforce census data to identify your requisite payroll tax requirements

- Identify potential payroll tax compliance concerns

- Review overview with a payroll tax specialist

- Review current year payroll tax history and notices

- And more!

HR Operations Review

HR Operations Review includes everything in the Payroll Tax Compliance Review and MORE, including full HR operations review relating to HR compliance and best practices. This review synthesizes with a roadmap to help you address any concerns.

HR Operations Review services include but not limited to:

- Everything included in Payroll Tax Compliance Review

- Review existing HR policies

- Review written processes like recruiting, onboarding and offboarding

- Identify existing HR organization chart

- Review critical HR written process & documents

- Review HR documentation storage process

- Review overview with a HR operations specialist

- And more!

.jpg?format=webp&quality=75&disable=upscale&width=358)

.jpg?format=webp&quality=75&disable=upscale&width=358)